When hundreds of thousands of people marched through the streets of Montreal calling for climate action last month, the evident reality that climate change is a pressing issue for many Canadians became even more apparent. At the forefront of this issue is the controversial and often misunderstood federal carbon tax implemented by Justin Trudeau of the Liberal Party. Carbon taxes, which are simply taxes levied on emissions from fossil fuel sources, offer the most cost-effective means of reducing carbon emissions (see: Fantastic Carbon Taxes And Why To Implement Them), hence their overwhelming popularity with economists. The popularity of the carbon tax among ivy-tower economists has not necessarily translated to a robust understanding in the general population. In a survey conducted in four Canadian provinces, 80% of respondents claimed the federal carbon tax had increased their cost of living.

On the surface, this statistic may seem uninteresting and frankly obvious — of course a tax that impacts the production of many different types of goods would increase the average cost of living. Except the poll took place two weeks before the federal carbon tax was actually implemented in those provinces.

Despite overwhelming expert consensus on the benefits of carbon pricing, skeptics and critics remain vocal. One of these critics is Andrew Scheer, leader of the Conservative Party and Prime Ministerial candidate. Scheer noticed the staggering lack of understanding surrounding the carbon tax bogeyman and has leveraged this throughout his electoral campaign. Consequently, his proposed environmental plan — dubbed ‘A Real Plan’ — lacks pragmatic and effective solutions to tackle the urgent threat of climate change.

For starters, Scheer’s plan completely glosses over Canada’s sizeable carbon dioxide (CO2) emissions, noting that Canada is a “small contributor to a global problem”. Alongside this statement is a chart that biasedly compares Canada’s total emissions to four of the largest economies in the world: The United States, China, the EU, and India. What is conveniently missed with this chart is how Canada has a comparatively minuscule population relative to the others. On a per-capita basis, we are the 13th highest emitting country in the world. The US is marginally higher at 10th, while China is 42nd and India is 117th.

Scheer’s crusade against the “failed Trudeau carbon tax” goes against mainstream academic consensus and instead functions as a political tool for misleading voters. With ridiculous platitudes in “A Real Plan”, such as how the carbon tax “hurts moms and dads driving their kids to and from hockey practice”, one might pity the intern who was tasked with writing this. Moving past the groan inducing clichés to the actual policies unfortunately doesn’t improve Scheer’s legitimacy.

Green technology, not taxes. That is the mantra of Scheer’s plan. Scheer postulates that the best way to fight climate change is to “make sure” that major emitters do their part to lower emissions and to incentivize green technological investments, all without carbon taxes. Except carbon taxes accomplish both of these things with less distortionary effects to the economy. A carbon tax intuitively makes any activity that produces CO2 more expensive than it would be without the tax. This levels the financial playing field for technologies that don’t produce any CO2 by making the technologies that do produce CO2 include the damage they cause to the environment in their costs. As a result, carbon taxes in and of themselves can induce innovation in cleaner technologies that are less damaging to the environment. This is because people respond to economic incentives such as higher prices. The carbon tax isn’t any different; take it from Scheer himself.

The smoking gun of the bad policy arsenal that is “A Real Plan” is the Green Homes Tax Credit (GHTC). This tax credit is designed to incentivize green home renovations in Canadian households over a 2-year period. While it sounds great on paper, a carbon tax can achieve a greater effect with far lower costs.

Scheer’s most common criticism of the carbon tax is that it is an expensive tax grab that is designed to rob the average Canadian. This is categorically untrue. Canada’s carbon tax is revenue neutral; 90% of the revenues collected are directly redistributed back to Canadian households, with the remaining 10% allocated for small businesses, hospitals, and other organizations.

Forecasted carbon tax revenues over a two-year period from 2019-2021 are about $6.5 billion. Subtracting 90% of this number (which is given back directly to Canadians) leaves $650 million, which alone seems massive, but pales in comparison to the $1.8 billion estimated cost of the GHTC over a 2-year period. Scheer would have a few different choices on how to fund the $1.8 billion: increasing taxes, cutting public services, or taking on debt. None of these seem particularly aligned with the conservative ethos of fiscal responsibility, and all of them would “make life harder and less affordable for Canadians” as directly said in “A Real Plan” with regards to the carbon tax. Additionally, both lower and middle-class Canadians actually receive more in rebates from the carbon tax than they pay, as the biggest polluters (aka those who pay the most in carbon taxes) are typically upper-income earners.

Okay, so the costs aren’t looking very attractive for Scheer. What about the effectiveness of the GHTC on reducing CO2 compared to carbon taxes?

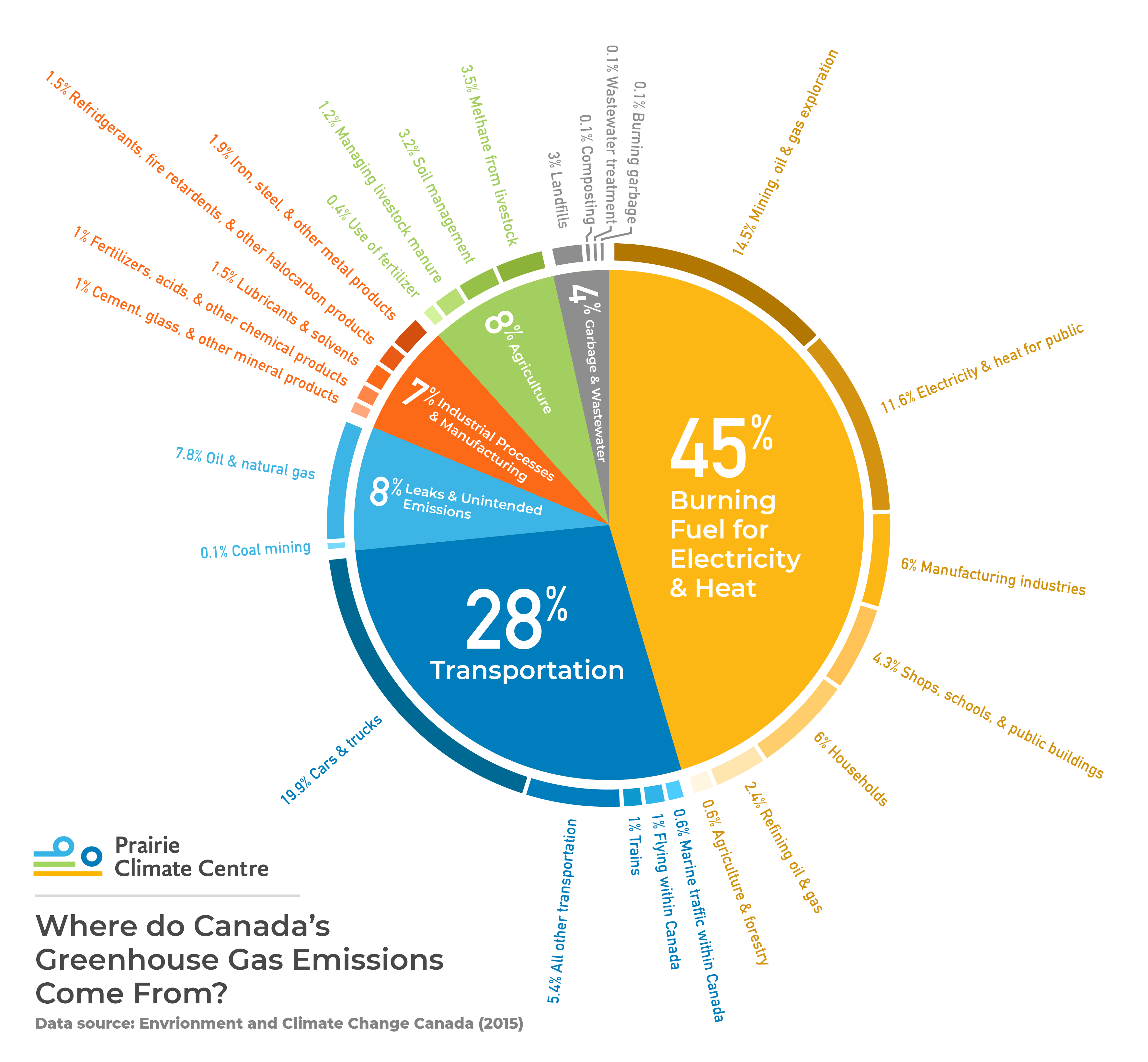

Unfortunately for Scheer, “A Real Plan” falls flat once again. The plan notes that buildings represented 12% of Canada’s emissions in 2017, but the GHTC only applies to homes, not to all buildings. As seen below, household fuel burning for electricity and heating accounts for a measly 6% of total greenhouse gas emissions in Canada. CO2 emissions are by far the greatest contributor to greenhouse gas emissions accounting for around 75% of them, which is why putting a price on carbon can have such substantial impacts on the environment. In fact, the carbon tax system implemented in British Columbia in 2008 reduced emissions by 5-15% compared to a counterfactual scenario without a carbon tax, all while having a negligible impact on the province’s economic performance.

The science is clear: carbon taxes work. Scheer has made a calculated political move to position himself as a champion of the average, hard-working Canadian by demonizing the carbon tax. Despite Scheer’s deliberate dismissal of facts, he is no fool, and is instead betting that he can gain votes by taking the opposite stance to Trudeau on this issue. Hopefully Canadian voters aren’t foolish either.