The skies haven’t been this still in decades. The pandemic has pulled in the reins on air traffic and, as a result, the aerospace industry has taken a hard hit. COVID-19 has left the industry high and dry as travel restrictions immobilize the world. Airbus and Boeing, the aircraft manufacturing giants, are having a hard time coping with the drastic shrinks in demand. It is clear that the momentum of the industry has been abruptly disturbed and market leaders are left struggling to hold their ground. As the global health crisis made its way across the world in early March, both Airbus and Boeing have been looking at high-impact solutions for their customers, employees, suppliers, and core business operations.

Production and Employment

According to Airbus’ financial reports, Airbus reacted instantly to the pandemic by reducing production rates of the A320, A330, and A350 families in March. Moreover, the company has announced its intention to reduce approximately 15000 positions across its workforce (5100 positions in Germany, 5000 positions in France, 1700 positions in the UK, 900 positions in Spain, and 1300 positions at Airbus’ other production sites). “Airbus is facing the gravest crisis this industry has ever experienced,” said Guillaume Faury, CEO of Airbus.

In its Q1 2020 financial report, Boeing acknowledged a considerable impact on the demand for new commercial airplanes, with delayed jet purchases by airlines, slower delivery schedules, and deferred elective maintenance. In April, Boeing initiated a voluntary layoff (VLO) plan that facilitated eligible employees who would like to make their exit from the company to do so with a pay and benefits package. This plan allowed the company to trim down its workforce by letting the willing employees go first. On top of this, Boeing reduced commercial airplane production rates. Late March saw the suspension of production and operations at sites across the Puget Sound area. In early April, Boeing temporarily suspended all its 787 operations going on at Boeing South Carolina (BSC).

Revenue and Income

Since the travel restrictions, passenger flight revenues have plummeted, giving birth to panic and chaos. The initial quarter saw a 49% decline in core profits for Airbus and the revenues descended to €2 billion from €10.6 billion. Commercial aircraft deliveries were down by 50%. Airbus completed 196 commercial deliveries in the first half of 2020 compared to 389 a year earlier. Fortunately for the consortium, the closing balance of Airbus for the Half Year 2020 (H1 2020) was positive. However, in terms of income, the company suffered a net loss.

| Airbus Parameters | H1 2020 | H1 2019 |

| Revenues in millions | 18,948 | 30,866 |

| Net Income/Loss in millions | -1,919 | 1,197 |

Boeing was already in deep water due to the grounding of its contemporary narrow body, B737 MAX. The American giant was looking at billions of dollars missing from its revenues. The pandemic is now expected to stretch the revenue gap further.

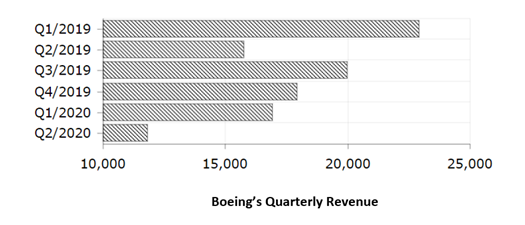

Boeing’s revenue has descended quarter-by-quarter since mid-2019. The second quarter of 2020 witnessed an abnormally low revenue, short by approximately 5000 million dollars compared to Q1.

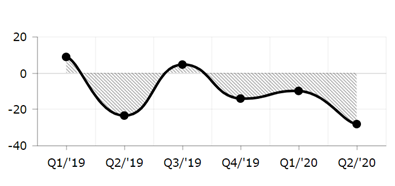

The graph above traces the core operating margin of Boeing from 2019 to 2020. It dipped twice in 2019 pointing to drastic instability and business turbulence. During the ongoing pandemic, the trend is drastically downward. Although the financial health of the company is low, spirits remain high. “Air travel has always proven to be resilient—and so has Boeing,” said David Calhoun, President and CEO of the Boeing Company. Given its federal support and political backing, it comes as no surprise that Boeing is quite resilient.

Desperate Measures

Airbus has been doing what is required to keep afloat while adhering to new regulations. It has suspended its dividend, slashed its production by a third, and furloughed an enormous amount of personnel in key locations. Over 3000 workers were furloughed at the Broughton wing factory in North Wales.

Boeing restructured leadership and organization in order to streamline its roles and responsibilities. Furthermore, Boeing has drawn on a term loan facility, reduced its operating costs as well as discretionary spending, extended the existing pause on share repurchases, suspended dividends, reduced R&D and capital expenditures, and eliminated Chairman and CEO pay for 2020.

Orders and Deliveries

The manufacturing giants take a lot of pride in the figures for their ‘orders and deliveries.’ Orders highlight the marketing success of a product and climbing orders add to the core revenues of the companies. Both companies keep a tab on their unfulfilled orders as well in order to update the backlog. Deliveries reflect whether the companies are on track with their production and assembly rates.

These numbers have witnessed some variation lately as over 16000 passenger jets have been grounded worldwide. Insufficient demand and air travel are rendering aircraft idle which is stacking up a different segment of costs for airlines. Mass grounding followed by mass storage is an unprecedented series of events that have revealed major difficulties that arise when planes do not fly. Planes are built to fly. Interestingly, a non-flying plane maintains a painful level of cost expenditure. A plane cannot simply be grounded and ignored until it is needed again. Maintenance is absolutely necessary if the plane desires to take off again at some point. Airlines end up incurring storage expenses, routine oversight expenses, as well as costs of preserving the engines, removing fluids, and installing protective casing.

Adding more planes to an already grounded fleet is simply irrational. What airlines ought to do is minimize the fleet by canceling orders, halting new orders, and retiring some planes earlier than expected. These decisions affect the aircraft manufacturers drastically as their orders and deliveries are getting shaken and trimmed. Airbus’ A321neo raked up 122 orders in January and 25 orders in March of 2020. Post March, the plane saw a total of 3 new orders till July-end. The A320neo had raked up 83 orders by March 2020 and was only able to secure 10 new orders over the course of the next four months.

The story of A380, the world’s largest jetliner, was already at its last chapter and the decision to slowly close production on the plane could not have come at a better time. Imagine an A380, the sole purpose of which is to carry a large number of people, being born at the start of the pandemic.

Boeing delivered 380 airplanes in the year 2019, averaging at around 31 planes per month. The company has delivered 87 planes in 2020 up to August, averaging at around 7 planes per month. Boeing secured 246 gross orders in 2019, averaging at 20 per month. The year 2020 has seen only 67 orders till now, averaging at 5 planes per month. Both companies have also shed many orders due to cancellations.

State support

The Boeing Company is an economic powerhouse and it significantly supports the American economy, particularly in terms of GDP and employment. The firm seems to have had strong political support throughout the decades. The Department of Commerce had infamously ruled to impose 300% tariffs on the 737 competitors, formerly Bombardier’s CSeries, currently Airbus’ A220 to safeguard Boeing’s interests in 2018. After the 737 MAX crashed twice in 2019, the company dwindled. In January 2020, the US President called Boeing “a disappointment.” On a side note, is it possible that Boeing has been slacking off in the safety department? Even some 787s have been causing problems recently. The manufacturing issues highly compromise the fundamental integrity of the plane and raise questions on production quality and control. Everybody makes mistakes, but they’re hardly justifiable at the cost of human lives.

Image source: https://unsplash.com/photos/y6Zx4qFkwgw

The national importance of Boeing suggests that the government will do anything to protect it. The federal government kept $17 billion aside for Boeing in its $2 trillion CARES Act. The company has also recently claimed to have raised over $20 billion in a bond offering. Similarly, Airbus has various governmental support mechanisms at its disposal. The European giant has, without a doubt, gone into the pandemic stronger than its rival Boeing. The compact A320s seem to sit right with the world we currently find ourselves within, while Boeing is faced with the biggest setback of its life and dives into the pandemic with a massive dent in its revenues.

The faster the industry plunges down, the slower it is anticipated to recover. The industry is looking at a span of possibly five years before it starts experiencing pre-pandemic parameters. The aircraft empires need to stay resilient, efficient, and economically cautious to make it through this catastrophe. Although Boeing has more reasons to worry than Airbus, both manufacturers need to pull their resources together and rough it out through the long, stormy night.

(The graphs are retrieved and created from financial reports of the companies. And the majority of the research is from Boeing and Airbus’ own financial statements available on their websites. The images are pulled from free stock image websites. They provide a representative visual of the situations described).