The past few months have turned Hong Kong from a shining example of economic growth to a reminder of just how quickly things can go wrong. The agitation was sparked by the proposal of new legislation allowing the extradition of Hong Kong dissenters and “fugitives” to mainland China. Though many feel that the bill was not radical enough to call for social displays of this magnitude, Hong Kong citizens felt that it was an attempt by the mainland Chinese to undermine their democratic rights. These rights — given to them under the principle of “One country, Two systems” — were installed when the British withdrew from the region in 1997.

With nearly 30 years left until the statute ends, the people of Hong Kong feel that their liberty is being eroded. Even after the bill was revoked, the protests continued and quickly transcended to become centred around the basic human right to democracy (or lack thereof) in China today. The situation has even deteriorated to the point that several state institutions, such as the Hong Kong Polytechnic University, have been forcibly taken over by protesters and turned into fortresses. It is the kind of thing you would expect to see in a Blockbuster action movie, not the metropolitan area of an economic superpower.

Source:https://www.cbc.ca/news/world/hong-kong-university-clashes-1.5362707

But unfortunately, the consequences of social unrest are never restrained to the political. The economic status of the state has been put into peril, and this may have dire consequences for the rest of the world if the situation is not handled carefully. There are many dimensions to the economic implications of these demonstrations, ranging from the blatant destruction of infrastructure to economic slowdown.

One source estimates that more than $10.5 million will be required for basic property maintenance following just the first few months of protests, and that over 91% of the city’s metro stops have been vandalized or damaged. But as hatred for the government has grown, so has the severity of the offences. Last month, facilitated by the city’s state of chaos, a string of armed robberies leading to a loss of over $5M in gold and jewelry took place. It is suspected that these were carried out by individuals affiliated with the protests. This is not an isolated incident either, as a member of the police force stated that there has been an average of one robbery per day in recent months, 2-3 times the frequency of 2018. This should be no surprise. Ask any humanities student who has read Émile Durkheim, and they will tell you that a breakdown of trust in society comes alongside a lack of respect for the rules of conduct in which they enforce.

All of this material destruction has a negative impact on the performance of retailers. People are afraid to go out shopping in the streets, and, even if they muster up the courage to do so, there is a chance that stores have been vandalized and looted. This, along with other contributing factors, led to a decrease of 24.4% in November retail sales, the largest single-month decline on record. This is not coincidental either; retail sales were trending upward prior to the social unrest. Just one year ago, in January 2019, retail sales were up 6.9%.

A large contributor to the retail slump is the impact on tourism. Hong Kong is a notorious shopping destination, especially for people from mainland China, as certain goods cannot be purchased elsewhere in the nation. However, the instability in the region has deterred visitors both from mainland China and the rest of the globe alike. In 2019, tourist arrivals declined 55.9% from the previous year, and the number of visitors from mainland China declined 58.4%. With the loss of these visitors comes the loss of the money they would otherwise spend during their visit.

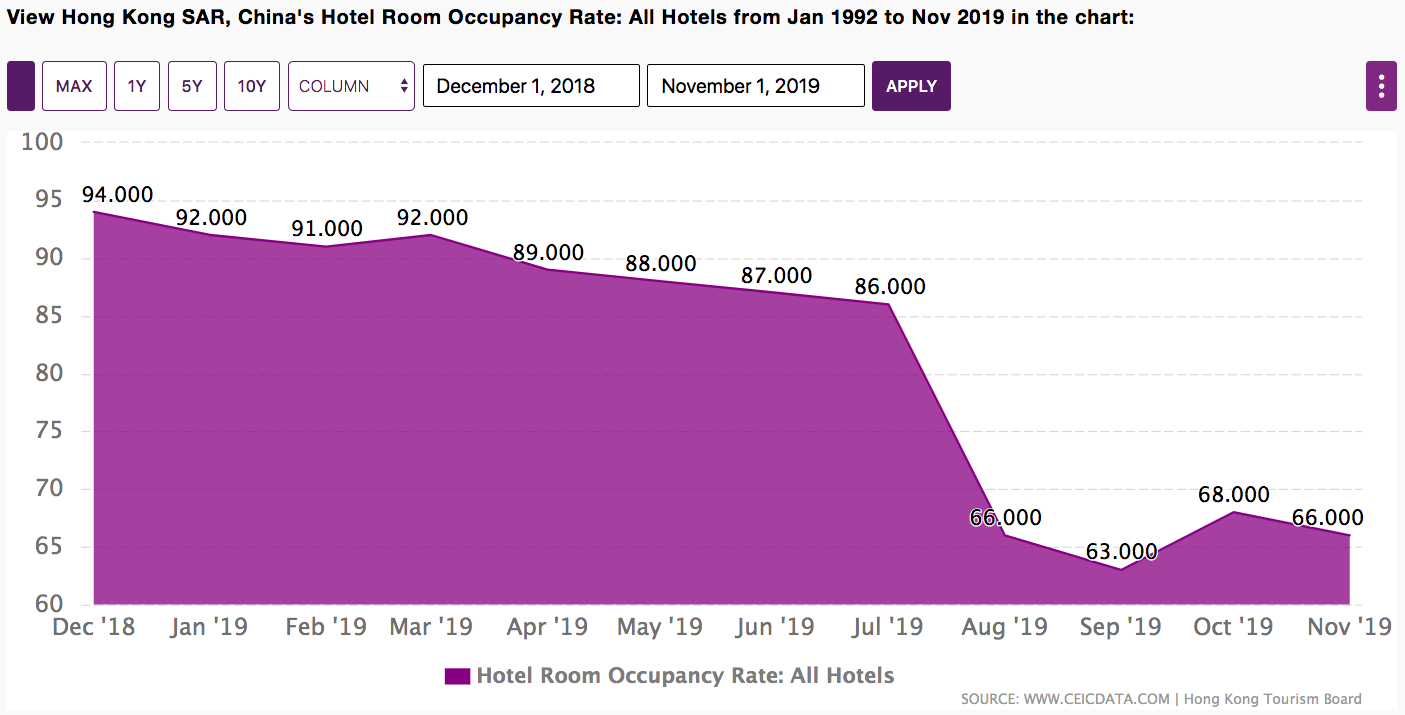

Unfortunately, this prediction has been realized. In November, Hong Kong announced that it had entered its first economic recession in the past decade, seeing a GDP growth rate of -3.2%. This is a slowdown in growth 6.2 times the magnitude of their next-largest decline in growth of the past decade. Being the largest port city on Earth, Hong Kong critically relies upon the flow of goods and people to support its economy. However, In November Hong Kong’s hotel occupancy rate was down 26%. Similarly, the number of people using Hong Kong’s public transportation systems was down 13.4% and the total flow of arrivals and departures is down 18.4% in October. What all this means is that this crucial flow of people and goods is slowing down, and at a remarkably fast rate. If this continues, Hong Kong will not just be looking at a short-lived downturn of the business cycle; they will face an exponentially worsening recession.

It doesn’t take an economics degree to know what typically follows from a recession: unemployment. As aggregate output falls, so does the need for firms to employ labor. This results in workers, ranging from unskilled to well-educated, being unable to find work. The unemployment rate in Hong Kong has for the past 2 years been extremely stable, barely deviating from 2.8%. But, coinciding with the beginning of the protests, the unemployment rate began to spike, rising to 3.3% in December. However, I predict that unemployment rate will grow to be much higher as Hong Kong heads into an ever-deeper recession. As the city is vandalized, retail stores begin to close, and people abandon their day jobs in order to take to the streets, Hong Kong will soon find itself with a much larger proportion of people not contributing to the society which they have begun to hate.